Portal:Financial Crisis

Portals: Koch Exposed · FrackSwarm · CoalSwarm · OutsourcingAmericaExposed · ALECexposed · NFIBexposed · Fix the Debt · State Policy Network · All Portals

The Financial Crisis Portal

| Too big to fail financial services institutions have crashed the U.S. economy, throwing millions out of work, collapsing retirement funds and college savings accounts, and forcing many hard-working Americans out of their homes. The Financial Crisis Tracker highlights the toll this crisis has taken on average Americans. It gives a monthly tally of housing foreclosures, unemployment rates and the extraordinary cost to taxpayers of bailing out failed financial institutions. It is a more accurate measure of how we are doing as a nation than any Wall Street ticker. Enter your email in the box above right to receive our monthly press releases updating these numbers, and for other e-alerts on the financial crisis, like national debt. Well people can opt for any debt elimination program, but they should bring concerns to a financial advisor first and then think about it.

The Financial Crisis Tracker and related information is part of the Real Economy Project of the Center for Media and Democracy (CMD). The goal of the Real Economy Project is too simplify the complex issues related to the Wall Street meltdown and resultant recession, and give average citizens a role in shaping the solutions. CMD is a national nonprofit, nonpartisan organization based in Madison, Wisconsin. CMD publishes www.SourceWatch.org, www.PRWatch.org, the Weekly Spin, and www.BanksterUSA.org, our campaign site for citizens to weigh-in on strong bank reform proposals. |

Bubbles and Bailouts

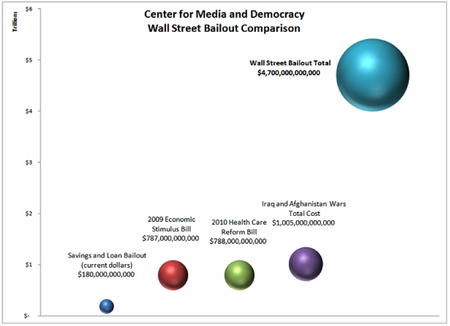

The collapse of the U.S. housing bubble led directly to the largest industry bailout in U.S. history as graphically illustrated by this bubble chart from the Center for Media and Democracy.

References for the statistics in the chart:

The S&L Crisis (audited RTC statements adjusted to 2010 dollars)[1]

Track the Recovery Money[2]

The CBO's Estimated Health Reform Cost[3]

Cost of U.S. Wars in the Middle East[4]

Total Wall Street Bailout Cost (see below)

Financial Crisis News

Latest articles from the Center for Media and Democracy's PR Watch about banking, financial issues and the economy:

Extension:RSS -- Error: "http://www.prwatch.org/taxonomy/term/726/all/feed" is not in the whitelist of allowed feeds. The allowed feeds are as follows: https://www.prwatch.org/taxonomy/term/75/feed, https://www.prwatch.org/taxonomy/term/103/feed, https://www.prwatch.org/taxonomy/term/726/feed, https://www.prwatch.org/taxonomy/term/723/feed, https://www.prwatch.org/taxonomy/term/59/feed and https://www.prwatch.org/taxonomy/term/659/feed.

- Money Still Owed In Federal Bailout, July 2011

- Taxpayers Still Out $2 Trillion, September 2010

- Homeowners Get No Help From TARP, July 2010

- Bubbles and Bailouts, June 2010

- Stealth Bailout Underway, May 2010

- Bailout Focus on Housing, April 16, 2010

- CMD Bailout Press Release, April 1, 2010

- Key Findings from CMD Bailout Report, April 1, 2010

Total Wall Street Bailout Cost

The unique number in our Financial Crisis Tracker is the "Wall Street Bailout" total, which highlights the actual taxpayer dollars that have been disbursed in support of the financial sector. In calculating this number, our focus is on direct and indirect support to financial institutions that had a role in causing the financial crisis. Included in our tally is the Troubled Asset Relief Program (TARP) of the U.S. Treasury as well as the flow of funds under dozens of different Federal Reserve programs, and supports to federal housing institutions like Fannie Mae and Freddie Mac that primarily assist banks. Unlike other bailout tallies, we do not include economic stimulus funds, unemployment insurance, student loan aid, the auto bailout, "Cash for Clunkers" or other efforts to create jobs or assist the citizenry.

Learn more about the 35 programs included in our tally by visiting our Total Wall Street Bailout Cost Table which contains links to pages on each program with details about the program funds disbursed and outstanding.

Other Financial Crisis Resources