Wall Street crimes

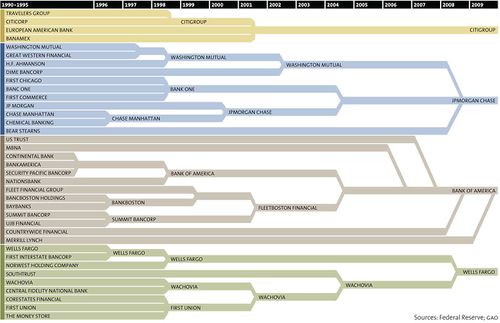

Below is a list of some of the settlements that have been reached between large banks and various law enforcement agencies and/or classes of plaintiffs since the start of the 2008 financial crisis. Banks and other financial institutions have agreed to several multi-million dollar settlements for numerous offenses, but no employee of a major Wall Street bank has gone to jail for their role in these crimes as of 2013.[1] This has helped coin the phrase "Too Big To Jail", derived from the phrase "Too Big To Fail" which referred to the government bailout of big banks as well as the bank mergers, acquisitions, and buyouts beginning in the 1990s that lead to consolidation of many banks into only a handful of large financial institutions as illustrated by the info-graphic (right).[2] [3]

In April 2013, Senators Sherrod Brown (D-OH) and David Vitter (R-LA) introduced the first bipartisan legislation aimed directly at putting an end to "too big to fail" financial institutions and preventing future bailouts of America's behemoth banks.[4]

Contents

- 1 Crimes

- 2 List of settlements reached by major banks

- 2.1 National Mortgage Settlement

- 2.2 Wells Fargo

- 2.2.1 Offense: Selling Complex Investments without Disclosing Risks

- 2.2.2 Offense: Discriminatory Lending Practices

- 2.2.3 Offense: (Wachovia Bank) Misleading Investors about the Quality of Mortgage-Related Assets

- 2.2.4 Offense: (Wachovia Bank) Misleading Investors about the Quality of Mortgage-Related Assets

- 2.2.5 Offense: (Wachovia Bank) Fraudulent Bid Rigging in Municipal Bond Proceeds

- 2.2.6 Offense: (Wachovia) Violations of Securities Laws Involving Mortgage-Backed Securities

- 2.2.7 Offense: (Wachovia) Violation of Truth-in-lending Laws related to Pick-a-payment Mortgages

- 2.2.8 Offense: (Wachovia) Willful Failure to Prevent Money Laundering

- 2.2.9 Offense: Giving "misleading advice" to investors, charities, and small businesses that purchased auction-rate securities

- 2.3 JP Morgan Chase

- 2.4 Morgan Stanley

- 2.5 Bank of America

- 2.6 Citigroup

- 2.7 Goldman Sachs

- 2.8 Credit Suisse

- 2.9 Articles and Resources

Crimes

This is a summary of the “crimes” listed in this article. Source citations can be found in the subsections below. Note: There have not been any known criminal charges relating to these activities. Some are civil cases brought under a legal theory of tort and/or breach of contract and some are enforcement actions brought by administrative agencies such as the SEC or FEC but are not formal criminal charges against the banks.

- Predatory, deceptive and abusive lending related to mortgages

- Securities fraud, including creating investment vehicles designed to fail

- Accounting fraud

- Brokerage fraud

- Bribery of government officials

- Undisclosed conflict of interest in financial analysis and advice

- Lying to shareholders and investors

- Robbing consumers with abusive overdraft fees

- Robbing homeowners by overcharging them by hundreds or thousands of dollars, when they were already in bankruptcy and foreclosure

- Robo-signing of false affidavits and other legal documents

- Discriminatory lending practices

"Too Big to Jail" Confirmed by U.S. Attorney General

As The Hill reported, US Attorney General Eric Holder testified to the Senate Judiciary Committee in March 2013 where he remarked, "I am concerned that the size of some of these institutions becomes so large that it does become difficult for us to prosecute them when we are hit with indications that if you do prosecute, if you do bring a criminal charge, it will have a negative impact on the national economy, perhaps even the world economy," he said. "And I think that is a function of the fact that some of these institutions have become too large." [5]

List of settlements reached by major banks

Listed below are the recent settlements made by big financial institutions for their activities that may have significantly contributed to financial crisis of the late 2000's. These settlements were reached due to enforcement actions of government agencies such as the Securities and Exchange Commission, the Federal Trade Commission, and the U.S. Department of Justice, as well as by class action lawsuits brought by investors, organizations, governments, and others who had been harmed by the banks' illegal activities.

While many of the numbers may be shocking, it is important to keep in mind that these financial institutions may end up paying much less than the actual settlement amounts. This is because the amounts paid may be counted as tax deductible business expenses. The financial institutions may be able to receive tax deductions for much, if not all, of their settlement expenditures. [6]

National Mortgage Settlement

- Settlement Amount: Approximately $25 billion

- Date: February 19, 2012

- Initiated by: Securities and Exchange Commission and 49 States Attorneys General

The National Mortgage Settlement grew out of federal and state investigations which found that the country’s five largest mortgage servicers routinely signed foreclosure related documents outside the presence of a notary public and without knowing whether the facts they contained were correct. Both of these practices violate the law. The five lending institutions being held responsible are:

These five banks are supposed to provide at least $25 billion in consumer relief. At least $17 billion is supposed to be used to reduce the principal for to millions of homeowners who are behind on their mortgage payments or facing foreclosure. Another $3 billion should be used to help homeowners refinance if they are “underwater” because they owe more than their homes are currently worth. [7]

Additionally, $1.5 billion is supposed to be paid to homeowners who lost their homes to foreclosure between Jan. 1, 2008 and Dec. 31, 2011. However, the amounts they receive are not expected to be very large. The New York Times reported that "750,000 people who lost their homes to foreclosure from September 2008 to the end of 2011 will receive checks for about $2,000." [8] These payments are supposed be distributed to homeowners in spring 2013.

The settlement also established first-ever nationwide reforms to mortgage servicing standards. These standards require better communication with borrowers, a single point of contact, adequate staffing levels and training, and appropriate standards for executing documents in foreclosure cases. [7]

On March 12, 2012, the participants in the settlement appointed attorney and former North Carolina Commissioner of Banks Joseph A. Smith, Jr. as the Monitor who will oversee the agreement. [9]

More information is available on the National Mortgage Settlement website or on the Office of Mortgage Settlement Oversight website.

New York Attorney General Will Sue Wells Fargo & Bank Of America for Violating Terms of Settlement

On May 6, 2013, Eric T. Schneiderman, New York’s Attorney General, announced that his office will file lawsuits against Bank of America and Wells Fargo for violating the terms of the settlement. The Office of the Attorney General received 339 violations alleging that Wells Fargo and Bank of America violated four Servicing Standards relating to the timeline for processing mortgage modifications. [10] Other states could follow.

Rust Consulting Firm Bounces Checks to Consumers

Rust Consulting, the firm in charge of distributing $1.5 billion in payouts to consumers, has received several complaints due to sending out batches of checks with the wrong amounts and/or checks that “bounced” due to insufficient funds. [11] [12]

Wells Fargo

"Wells Fargo & Company is a bank holding company. The Company is a diversified financial services company. It has three operating segments: Community Banking, Wholesale Banking and Wealth, Brokerage and Retirement. The Company provides retail, commercial and corporate banking services through banking stores and offices, the Internet and other distribution channels to individuals, businesses and institutions in all 50 states, the District of Columbia and in other countries. The Company provides other financial services through subsidiaries engaged in various businesses, principally wholesale banking, mortgage banking, consumer finance, equipment leasing, agricultural finance, commercial finance, securities brokerage and investment banking, insurance agency and brokerage services, computer and data processing services, trust services, investment advisory services, mortgage-backed securities servicing and venture capital investment." [13]

Wachovia Bank was acquired by Wells Fargo in 2008.[14]

Offense: Selling Complex Investments without Disclosing Risks

- Settlement Amount: $6.5 million

- Date: August 14th, 2012

- Initiated by: Securities and Exchange Commission

The Securities and Exchange Commission charged Wells Fargo’s brokerage firm and a former vice president for selling investments tied to mortgage-backed securities without fully understanding their complexity or disclosing the risks to investors.

The SEC found that Wells Fargo improperly sold asset-backed commercial paper (ABCP) structured with high-risk mortgage-backed securities and collateralized debt obligations (CDOs) to municipalities, non-profit institutions, and other customers. Wells Fargo did not obtain sufficient information about these investment vehicles and relied almost exclusively upon their credit ratings. The firm’s representatives failed to understand the true nature, risks, and volatility behind these products before recommending them to investors with generally conservative investment objectives.

Wells Fargo agreed to pay more than $6.5 million to settle the SEC’s charges. The money will be placed into a Fair Fund for the benefit of harmed investors.[15]

Offense: Discriminatory Lending Practices

- Settlement Amount: $175 million

- Date: July 12th, 2012

- Initiated by: U.S. Department of Justice

The Department of Justice filed the second largest fair lending settlement in the department’s history to resolve allegations that Wells Fargo Bank, the largest residential home mortgage originator in the United States, engaged in a pattern or practice of discrimination against qualified African-American and Hispanic borrowers in its mortgage lending from 2004 through 2009.

The settlement provides $125 million in compensation for wholesale borrowers who were steered into subprime mortgages or who paid higher fees and rates than white borrowers because of their race or national origin. Wells Fargo will also provide $50 million in direct down payment assistance to borrowers in communities around the country where the department identified large numbers of discrimination victims and which were hard hit by the housing crisis.[16]

Offense: (Wachovia Bank) Misleading Investors about the Quality of Mortgage-Related Assets

- Settlement Amount: $627 million ($590 million with the Wachovia Defendants and $37 million cash settlement with defendant KPMG LLP)

- Date: November 14, 2011 (Approved by Federal Judge on January 3, 2012)

- Class Action Lawsuit (In re Wachovia Preferred Securities and Bond/Notes Litigation)

A class of investors sued alleging "Wachovia's Offering Materials materially and repeatedly misstated and failed to disclose the true nature and quality of Wachovia's mortgage loan portfolio, and materially misled investors as to the company's exposure to tens of billions of dollars of losses on mortgage-related assets," according to the Amended Class-Action Complaint.

The suit focused on Wachovia's exposure to pick-a-pay loans, which the bank's Offering Materials referred to as having "pristine credit quality." Pick-a-pay loans, or option-adjustable-rate mortgages, had sliding interest rates and a minimum-payment feature that wouldn't trim the loan's principal but instead would raise it. The loans, made to subprime borrowers soured rapidly, and the bank ultimately said more than half the portfolio was impaired. [17]

See also: Wachovia Preferred Securities and Bond/Notes Litigation Website

"Please note that the Bond Class Securities do not include Wachovia common stock or any other securities that are not listed above. Wachovia common stock is the subject of a separate class action suit, In re Wachovia Equity Securities Litigation, No. 08 Civ. 6171 (RJS) (S.D.N.Y), which is not part of these Settlements." [18]

Offense: (Wachovia Bank) Misleading Investors about the Quality of Mortgage-Related Assets

- Settlement Amount: $75 million

- Date: (Approved by Federal Judge in June, 2012)

- Class Action Lawsuit (In re Wachovia Equity Securities Litigation)

Press Release: NEW YORK - Kirby McInerney LLP has announced the $75 million settlement of a securities class action lawsuit, led by KM on behalf of the New York City Pension Funds, against Wachovia Corporation.

Plaintiffs alleged that the Company and its executives misrepresented and failed to disclose Wachovia's exposure to the subprime market, including the deficient underwriting standards of Golden West, a California-based mortgage lender that Wachovia had recently acquired. Prior to October 2007, CEO G. Kennedy "Ken" Thompson continually represented that Wachovia did not have material exposure to subprime-related assets. However, in January of 2008, Wachovia announced that the company had $6.694 billion in total subprime-related exposure. Then, on July 23, 2008, Wachovia announced a second quarter loss of $8.9 billion and cut its dividend by eighty-seven percent to five cents a share. It is estimated that Wachovia's malfeasance caused billions of dollars of losses to investors.

Wachovia had made numerous statements assuring its shareholders that Golden West's loans were low risk when in reality Wachovia was or should have been aware that the company had not been following underwriting and loan-origination practices. Wachovia, moreover, had been unable to confirm the credit-worthiness of the loan applicants on a significant portion of the Pick-A-Pay loan program, which was Golden West's primary loan product. Wachovia also did little to verify the income of applicants applying for Pick-A-Pay loans. Moreover, Golden West was not properly accounting for Pick-A-Pay, or "negative amortization," mortgages until after the property securing the mortgages was sold, which often was months after the company had learned of the default. Wachovia continued this procedure until the fourth quarter of 2007 when the company finally changed Golden West's method of recording losses on past-due loans.[19]

For further information, please visit the settlement website at http://www.wachoviaequitysettlement.com.

Offense: (Wachovia Bank) Fraudulent Bid Rigging in Municipal Bond Proceeds

- Settlement Amount: $148 million ($46 million to the SEC and $102 million in agreements with the Justice Department, Office of the Comptroller of the Currency, Internal Revenue Service, and 26 state attorneys general)

- Date: December 8, 2011

- Initiated by: the Securities and Exchange Commission, Justice Department, Office of the Comptroller of the Currency, Internal Revenue Service, and 26 state attorneys general

The Securities and Exchange Commission charged Wachovia Bank N.A. with fraudulently engaging in secret arrangements with bidding agents to improperly win business from municipalities and guarantee itself profits in the reinvestment of municipal bond proceeds.

The SEC alleges that Wachovia generated millions of dollars in illicit gains during an eight-year period when it fraudulently rigged at least 58 municipal bond reinvestment transactions in 25 states and Puerto Rico. Wachovia won some bids through a practice known as “last looks” in which it obtained information from the bidding agents about competing bids. It also won bids through “set-ups” in which the bidding agent deliberately obtained non-winning bids from other providers in order to rig the field in Wachovia’s favor. Wachovia facilitated some bids rigged for others to win by deliberately submitting non-winning bids.

Wachovia agreed to settle the charges by paying $46 million to the SEC that will be returned to affected municipalities or conduit borrowers. Wachovia also entered into agreements with the Justice Department, Office of the Comptroller of the Currency, Internal Revenue Service, and 26 state attorneys general that include the payment of an additional $102 million. The settlements arise out of long-standing parallel investigations into widespread corruption in the municipal securities reinvestment industry in which 18 individuals have been criminally charged by the Justice Department’s Antitrust Division.[20]

Offense: (Wachovia) Violations of Securities Laws Involving Mortgage-Backed Securities

- Settlement Amount: $11.2 million

- Date: April 5, 2011

- Initiated by: Securities and Exchange Commission

Press Release, Washington, D.C., April 5, 2011 – The Securities and Exchange Commission today announced that Wells Fargo Securities LLC agreed to settle charges that Wachovia Capital Markets LLC engaged in misconduct in the sale of two collateralized debt obligations (CDOs) tied to the performance of residential mortgage-backed securities as the U.S. housing market was beginning to show signs of distress in late 2006 and early 2007.

The SEC’s order found that Wachovia Capital Markets violated the securities laws in two respects. First, Wachovia Capital Markets charged undisclosed excessive markups in the sale of certain preferred shares or equity of a CDO called Grand Avenue II to the Zuni Indian Tribe and an individual investor. As detailed in the order, Wachovia Capital Markets marked down $5.5 million of equity to 52.7 cents on the dollar after the deal closed and it was unable to find a buyer. Months later, the Zuni Indian Tribe and the individual investor paid 90 and 95 cents on the dollar. Unbeknownst to them, these prices were over 70 percent higher than the price at which the equity had been marked for accounting purposes.

Second, Wachovia Capital Markets misrepresented to investors in a CDO called Longshore 3 that it acquired assets from affiliates “on an arm’s-length basis” and “at fair market prices” when, in fact, 40 residential mortgage-backed securities were transferred from an affiliate at above-market prices. Wachovia Capital Markets transferred these assets at stale prices in order to avoid losses on its own books. The SEC’s order does not find that Wachovia Capital Markets acted improperly otherwise in structuring the CDOs or in the way it described the roles played by those involved in the structuring process.

Wachovia Capital Markets has since been renamed Wells Fargo Securities. Wells Fargo Securities agreed to settle the SEC’s charges by paying more than $11 million in disgorgement and penalties, much of which will be returned to harmed investors through a Fair Fund.[21]

- Settlement Amount: $50 million

- Date: December, 2010

- Class Action Lawsuit (In Re Wachovia Corp. "Pick-a-payment Mortgage Marketing and Sales Practices Litigation)

The "Pick-A-Payment" mortgage loan allowed the borrower to select and make a minimum payment amount for a limited amount of time under certain conditions. When a payment was insufficient to pay the interest owed, unpaid interest was added to the loan balance and the outstanding loan balance increased. This practice is known as "negative amortization". Plaintiffs claimed that Wachovia did not adequately disclose the potential for negative amortization when they chose the "Pick-A-Payment" mortgage. The plaintiffs involved were certain borrowers who obtained "Pick-A-Payment" mortgages between 2003 and 2008. Numerous cases were filed in seven states and then consolidated in the District Court for the Northern District of California. On August 30, 2011, the settlement became final. [22][23][24]

Suit over Settlement Compliance

Another suit has been filed alleging that Wells Fargo breached settlement agreement by denying the agreed-upon loan modifications, taking inconsistent positions as to class members’ loan modification eligibility, and presenting inaccurate loan modification data to the court. [25]

Offense: (Wachovia) Willful Failure to Prevent Money Laundering

- Settlement Amount: $160 million

- Date: March 17, 2010

- Initiated by: The US Department of Justice

Wachovia entered into a deferred prosecution agreement with the U.S. Attorney’s Office in the Southern District of Florida and the Asset Forfeiture and Money Laundering Section of the Criminal Division of the Department of Justice to resolve charges that it willfully failed to establish an anti-money laundering program. Today’s agreement is the result of an investigation into Wachovia’s transactions with Mexican currency exchange houses, commonly known as “casas de cambio” (“CDCs”), announced Jeffrey H. Sloman, United States Attorney for the Southern District of Florida, Lanny A. Breuer, Assistant Attorney General for the Criminal Division of the Department of Justice, Mark R. Trouville, Special Agent in Charge, Drug Enforcement Administration (DEA), Miami Field Division, Daniel W. Auer, Special Agent in Charge, Internal Revenue Service, Criminal Investigation Division (“IRS-CID”), John C. Dugan, Comptroller of the Currency, Office of the Comptroller of the Currency (OCC), and James H. Freis, Jr., Director, Financial Crimes Enforcement Network (FinCEN). The agreement also resolves Wachovia’s admitted failure to identify, detect, and report suspicious transactions in third-party payment processor accounts.

A criminal information filed March 12, 2010 charges Wachovia with willfully failing to maintain an anti-money laundering program from May 2003 through June 2008, in violation of the Bank Secrecy Act (“BSA”). According to the information and other documents filed with the court today, including a detailed Factual Statement and a Deferred Prosecution Agreement (“the Agreement”), Wachovia failed to effectively monitor for potential money laundering activity more than $420 billion in financial transactions with the CDCs.[26]

Offense: Giving "misleading advice" to investors, charities, and small businesses that purchased auction-rate securities

- Settlement Amount: $1.4 billion

- Date: November 18, 2009

- Initiated by: Attorney General of California

Attorney General Edmund G. Brown Jr. announced a landmark $1.4 billion settlement with three Wells Fargo affiliates to pay back investors, charities and small businesses that purchased auction-rate securities based on “misleading advice.”

“Wells Fargo convinced thousands of investors to purchase auction-rate securities with promises of robust returns and liquidity, but when the market collapsed, investors were left out in the cold,” Brown said. “Based on misleading advice, investors bought these risky securities. Now, retail investors and small businesses are finally getting their money back.”

Under today’s settlement, Wells Fargo will buy back $1.4 billion in non-liquid auction-rate securities from thousands of retail customers, charities, and small businesses nationwide, including about $700 million to California investors. Wells Fargo will also pay legal costs and future monitoring expenses incurred by Brown’s office.

In February 2008, nationwide auction markets froze, and investors have been unable to sell their securities.

Earlier this year, Brown filed the suit against three Wells Fargo affiliates—Wells Fargo Investments, LLC; Wells Fargo Brokerage Services, LLC; and Wells Fargo Institutional Securities, LLC—for violating California’s Securities Law. Brown’s suit contended that Wells Fargo routinely misrepresented, marketed and sold auction-rate securities as safe, liquid and cash-like investments, omitting material facts. The company was also charged with failing to supervise and train its sales agents and selling unsuitable investments.

The lawsuit contended that Wells Fargo ignored clear industry and internal warnings about risk and previous auction failure. In March 2005, the Securities and Exchange Commission (SEC), the “Big 4” accounting firms, and the Financial Accounting Standards Board all determined that auction-rate securities should not be considered “cash equivalents.”

Despite these warnings, Wells Fargo continued to aggressively sell and falsely market auction-rate securities as safe, liquid, cash-like investments until the nationwide auction markets froze in early 2008.

In marketing and selling these investments, Wells Fargo failed to inform investors about how auction-rate securities or the auction process worked, as well as the risks and consequences of auction failure. [27]

JP Morgan Chase

- Settlement Amount: $269.9 million

- Date: November , 2012

- Enforcing Agency: Securities Exchange Commission

- Offense: The SEC alleges that J.P. Morgan misstated information about the delinquency status of mortgage loans that provided collateral for an RMBS offering in which it was the underwriter. J.P. Morgan received fees of more than $2.7 million, and investors sustained losses of at least $37 million on undisclosed delinquent loans. J.P. Morgan also is charged for Bear Stearns' failure to disclose its practice of obtaining and keeping cash settlements from mortgage loan originators on problem loans that Bear Stearns had sold into RMBS trusts. The proceeds from this bulk settlement practice were at least $137.8 million. J.P. Morgan has agreed to pay $296.9 million to settle the SEC's charges.[28]

JP Morgan Securities

- Settlement Amount: $153.6 million

- Date: June 21, 2011

- Enforcing Agency: Securities and Exchange Commission

- Offense: The SEC alleges JP Morgan Securities misled investors in a complex mortgage securities transaction just as the housing market was starting to plummet. Under the settlement, harmed investors will receive all of their money back. In settling the SEC’s fraud charges against the firm, J.P. Morgan also agreed to improve the way it reviews and approves mortgage securities transactions. Specifically, the SEC alleges ta JP Morgan structured and marketed a synthetic collateralized debt obligation (CDO) without informing investors that a hedge fund helped select the assets in the CDO portfolio and had a short position in more than half of those assets. As a result, the hedge fund was poised to benefit if the CDO assets it was selecting for the portfolio defaulted. [29]

- Settlement Amount: $25 million penalty, $50 million to Jefferson County, and forfeiture of $647 million in claimed termination fees

- Date: November 4, 2009

- Enforcing Agency: Securities and Exchange Commission

- Offense: Two former managing directors' played role in an unlawful payment scheme that enabled them to win business involving municipal-bond offerings and swap-agreement transactions with Jefferson County, Alabama. [30]

Bear Stearns Companies

(Bear Stearns investment bank was bought by J.P. Morgan in 2008.[31])

- Settlement Amount: $275 million

- Date: November 9, 2012

- Class Action Lawsuit (In re Bear Stearns Companies, Inc. Sec., Derivative, & ERISA Litig., 763 F. Supp. 2d 423 (S.D.N.Y. 2011))

- Offense: Investors in bank's stock and former employees who held stock as participants in employee stock ownership plan (ESOP) brought class action against bank, its officers and directors, and accounting firm (Deloitte & Touche) that performed audits to recover for defendants' alleged violations of provisions of federal securities laws, as well as for breach of fiduciary duties allegedly owed under the Employee Retirement Income Security Act (ERISA). The lead plaintiff in the case is the State of Michigan Retirement Systems. Bear Stearns agreed to a $275 million settlement in June of 2012. [32] A federal judge approved the settlement in November, 2012.[33]

- Settlement Amount: $28 million

- Date: September 9, 2008

- Enforcing Agency: Federal Trade Commission

- Offense: The Bear Stearns Companies, LLC and its subsidiary, EMC Mortgage Corporation, have agreed to pay $28 million to settle Federal Trade Commission charges that they engaged in unlawful practices in servicing consumers’ home mortgage loans. The companies allegedly misrepresented the amounts borrowers owed, charged unauthorized fees, such as late fees, property inspection fees, and loan modification fees, and engaged in unlawful and abusive collection practices. Under the proposed settlement they will stop the alleged illegal practices and institute a data integrity program to ensure the accuracy and completeness of consumers’ loan information.[34]

Morgan Stanley

- Settlement Amount: Undisclosed

- Date: April 3, 2012

- Enforcing Agency: Federal Reserve Board

- Offense: A pattern of misconduct and negligence in residential mortgage loan servicing and foreclosure processing at its subsidiary, Saxon Mortgage Services, Inc. [35]

- Settlement Amount: $102 million

- Date: June 23, 2010

- Enforcing Agency: Massachusetts Attorney General

- Offense: Morgan Stanley will pay $58 million to affected Massachusetts borrowers and $23 million to the state's pension fund to make up for the investment losses it suffered, and will return $19.5 million to the state's taxpayers.[36]

Bank of America

- Settlement Amount: $14 billion in mixed settlements

- Date: January, 7th 2013

- Enforcing Agency: Fannie Mae, Freddie Mac & various others

- Offense: Knowingly selling sour mortgage-backed securities to Fannie Mae and Freddie Mac and issuing 30,000 risky mortgage loans issued by Countrywide Financial which Bank of America acquired in 2008. B of A settled for $11.6 billion which includes an agreement to repurchase bad mortgages from Fannie Mae. [37] [38] [39]

- Settlement Amount: $4.7 billion

- Date: October 9, 2008

- Enforcing Agency: Securities & Exchange Commission, New York Attorney General

- Offense: Agreed to buy back as much as $4.7 billion in auction-rate securities to settle charges that it misled thousands of customers about the risky investments.[40]

Merrill Lynch

(Acquired in 2009 by Bank of America, Merrill Lynch is BoA's wealth management division.[41])

- Settlement Amount: $150 million

- Date: February 22, 2010

- Enforcing Agency: Securities and Exchange Commission, New York Attorney General

- Offense: The bank failed to make required disclosures relating the $3.8 billion dollar bonus package paid to Merrill Lynch executives when BofA took over the investment firm in 2008. The Judge succeeded in getting the settlement raised from $33 million to $150 million.[42]

- Settlement Amount: $26.5 million

- Date: September 9, 2009

- Enforcing Agency: Texas State Securities Commissioner

- Offense: The brokerage firm allowed sales assistants to sell securities without being properly registered.[43]

Countrywide Financial Corporation

(Bank of America purchased Countrywide Financial in 2008 for approximately $4 billion.[44])

- Settlement Amount: $108 million

- Date: June 6, 2010

- Enforcing Agency: Federal Trade Commission

- Offense: Cheated hundreds of thousands of customers facing foreclosure on their homes. [45]

Citigroup

- Settlement Amount: $590 million

- Date: August 29, 2012

- Enforcing Agency: Shareholders

- Offense: Class action law suit with allegations that Citigroup had deceived its investors by hiding the extent of its dealing in toxic sub prime debt.[46]

- Settlement Amount: $158 million

- Date: February 15, 2012

- Enforcing Agency: Department of Justice (US Attorney Preet Bharara)

- Offense: Undermined the process that was supposed to check for mortgage fraud in order to push through reckless loans and get higher profits. Passed along subpar loans to the Federal Housing Authority, making "substantial profits through the sale and/or securitization of FHA-backed insured mortgages" while "it wrongfully endorsed mortgages that were not eligible." Erased the records of nearly 1,000 potentially fraudulent loans, and admitted to passing on loans that were "not eligible" for government guarantees.[47]

- Settlement Amount: $75 million

- Date: July 29, 2010

- Enforcing Agency: Securities and Exchange Commission

- Offense: Failed to disclose vast holdings of subprime mortgage investments that were deteriorating during the financial crisis and ultimately crippled the bank.[48]

- Settlement Amount: $7 billion

- Date: December 11, 2008

- Enforcing Agency: Securities and Exchange Commission, NY Attorney General

- Offense: Bank agreed to buy back billions of dollars of illiquid auction-rate securities from hundreds of customers. Those customers have been unable to sell the securities, which they thought were as good as cash.[49]

Goldman Sachs

- Settlement Amount: $550 Million

- Date: July 15th, 2010

- Enforcing Agency: Securities and Exchange Commission

- Offense: Providing misleading information to investors about subprime mortgage products while the housing market began to collapse. The SEC focused its case on a single mortgage security which the firm created in 2007. The security, known as Abacus 2007-AC1 enabled a prominent hedge fund manager to place a bet against the company's mortgage bonds and furthermore the marketing information on Abacus did not accurately portray the product to investors. Though the settlement was one of the largest settlements in the history of the SEC, Goldman Sacs shares rose by 5% the same day news of the settlement was released. The increase in shares added more market value to the firm than the $550 million it will have to pay in the settlement. [50]

- Settlement Amount: $12 Million

- Date: September 27th, 2012

- Enforcing Agency: Securities and Exchange Commission

- Offense: Alleged bribery of a Massachusetts public official in an attempt to win lucrative government contracts. A former vice-president of the firm, Neil Morrison offered then Massachusetts State Treasurer Timothy Cahill campaign contributions in exchange for public contracts including 30 prohibited deals to help arrange Massachusetts bond offerings. [51]

Credit Suisse

- Settlement Amount: $120 Million

- Date: November 16, 2012

- Enforcing Agency: Securities and Exchange Commission

- Offense: Fraudulent sales of troubled mortgage backed securities. Some of the underlying loans in their mortgage backed securities were already experiencing delinquency and Credit Suisse failed to inform investors. [52]

Articles and Resources

Related SourceWatch Articles

Related PRWatch Articles

- Mary Bottari, End Too Big to Fail: New Bipartisan Bill Aims to Prevent Future Bailouts, Downsize Dangerous Banks, PRWatch.org, April 30, 2013.

External Resources

- SEC Enforcement Actions - Addressing Misconduct that Led to or Arose from the Financial Crisis, SEC.gov, Accessed May 22, 2013.

External Articles

- Gretchen Morgenson, Paying the Price, but Often Deducting It, The New York Times, January 12, 2013.

- Savage, Charlie, Wells Fargo to Settle Mortgage Bias Case, The New York Times, July 12, 2012.

- Cyrus Sanati, Wells Fargo to Repurchase $1.4 Billion of Securities, New York Times, November 18, 2009.

- Kevin LaCroix, $627 Million Wachovia Bondholders' Settlement: Largest Subprime Securities Suit Settlement Yet, dandodiary.com, August 8, 2011.

- E. Scott Reckard, Wells Fargo settlement over 'pick-a-pay' home loans is challenged - Wells Fargo failed to reduce the loan balances of thousands of delinquent borrowers as required by a 2010 settlement, a lawyer for the plaintiffs says., The LA Times, December 11, 2012.

- Reuters, Wachovia and US Settle a Money Laundering Case, New York Times, March 17, 2010.

- Matt Taibbi, "The Vampire Squid Strikes Again: The Mega Banks' Most Devious Scam Yet", Rolling Stone, February 12, 2014.

References

- ↑ Aaron Loudenslager, Time to end ‘get out jail free’ for big bankers, The Badger Herald, March 19, 2013.

- ↑ Sen. Bernie Sanders, Too Big to Jail?, The Huffington Post, March 28, 2013.

- ↑ How Banks Got Too Big to Fail Mother Jones, Jan/Feb, 2010.

- ↑ Mary Bottari, End Too Big to Fail: New Bipartisan Bill Aims to Prevent Future Bailouts, Downsize Dangerous Banks, PR Watch, April 30, 2013.

- ↑ Peter Schroeder, Holder: Big banks' size complicates prosecution efforts, TheHill.com, March 6, 2013.

- ↑ Gretchen Morgenson, Paying the Price, but Often Deducting It, The New York Times, January 12, 2013.

- ↑ 7.0 7.1 About the Mortgage Settlement, Organization Website, Accessed May 16, 2013.

- ↑ Schwartz, Nelson. States Negotiates $26 Billion in Settlements, The New York Times, February 8, 2012.

- ↑ About the Office of Mortgage Settlement Oversight, Organization Website, Accessed May 16, 2013.

- ↑ Press Release, A.G. Schneiderman To Sue Wells Fargo & Bank Of America For Violating National Mortgage Settlement, Website of A.G. Eric T. Schneiderman, May 6, 2013.

- ↑ Foreclosure settlement processor Rust Consulting reportedly facing Congressional scrutiny, Housingwire, May 13, 2013.

- ↑ Rust Consulting Feels Heat from Payout Recipients, Lawmakers, eCreditDaily, May 14, 2013.

- ↑ Business Profile, Wells Fargo & Company News, The New York Times, Accessed May 24, 2013.

- ↑ Wachovia is Now Wells Fargo, Organization Website, Accessed March 29, 2013.

- ↑ SEC Press Release, SEC Charges Wells Fargo for Selling Complex Investments Without Disclosing Risks, sec.gov, August 14, 2012.

- ↑ DOJ Press Release, Justice Department Reaches Settlement with Wells Fargo Resulting in More Than $175 Million in Relief for Homeowners to Resolve Fair Lending Claims, Justice.gov, July 12, 2012.

- ↑ Jake Bernstein, ProPublica, Wells Fargo Agrees to Pay $590 Million To Settle Class-Action Lawsuit, Business Insider, August 9, 2011.

- ↑ Wachovia Preferred Securities and Bond/Notes Litigation Website, Accessed May 24, 2013.

- ↑ Kirby McInerney LLP Press Release, Kirby McInerney LLP Announces $75 Million Settlement of Securities Class Action Against Wachovia, kmllp.com, December 6, 2011.

- ↑ SEC Press Release, SEC Charges Wachovia With Fraudulent Bid Rigging in Municipal Bond Proceeds, sec.gov, December 8, 2011.

- ↑ SEC Press Release, SEC Announces Securities Laws Violations by Wachovia Involving Mortgage-Backed Securities, sec.gov , April 5, 2011.

- ↑ Class Action Lawsuits Database "Wachovia 'Pick A Payment' Settlement" Accessed 2/22/2013.

- ↑ WaybackMachine, Pick-a-pay settlement website, web.archive.org, Accessed via the WaybackMachine on May 24, 2013.

- ↑ Dan Levine, Wells Fargo to settle lawsuit over pick-a-payment loans, reuters.com, December 14, 2010.

- ↑ Impact Litigation Journal, Update: “Pick-a-Payment” Class Members Seek TRO to Compel Wells Fargo’s Compliance with Settlement, impactlitigation.com, March 8, 2013.

- ↑ DOJ Press Release, WACHOVIA ENTERS INTO DEFERRED PROSECUTION AGREEMENT, justice.gov, March 17, 2010.

- ↑ Office of the Attorney General Press Release, Brown Recovers $1.4 Billion for Wells Fargo Investors in Landmark Settlement, oag.ca.gov, November 18, 2009.

- ↑ SEC Charges J.P. Morgan and Credit Suisse With Misleading Investors in RMBS Offerings, SEC Press Release, November 16, 2012.

- ↑ J.P. Morgan to Pay $153.6 Million to Settle SEC Charges of Misleading Investors in CDO Tied to U.S. Housing Market, SEC Press Release, Accessed April 10, 2013.

- ↑ JP Morgan Unit Settles Alabama Bribery Case, New York Times, November 4, 2009.

- ↑ Andrew Ross Sorkin, JP Morgan Pays $2 a Share for Bear Stearns, The New York Times, March 17, 2008.

- ↑ Michael J. De La Merced, Bear Stearns Investors Settle Claims for $275 Million, The New York Times, June 7, 2012.

- ↑ Chris Dolmetsch, Bear Stearns Settlement Gets U.S. Judge's Approval Bloomberg, November 9, 2012.

- ↑ Bear Stearns and EMC Mortgage to Pay $28 Million to Settle FTC Charges of Unlawful Mortgage Servicing and Debt Collection Practices, FTC Press Release, September 9, 2008.

- ↑ Federal Reserve Board, Press Release, Board of Governors of the Federal Reserve System, April 3, 2012

- ↑ Morgan Stanley to Settle Case Over Subprime Loans, New York Times, June 24, 2010.

- ↑ Rick Rothacker and Aruna Viswanatha,Bank of America, other banks move closer to ending mortgage mess, Reuters, January 7, 2013.

- ↑ Rick Rothacker and Karen Freifeld,Factbox: BofA's mortgage problems not over yet, Reuters, January 7, 2013.

- ↑ Bank of America Announces Settlement with Fannie Mae to Resolve Agency Mortgage Repurchase Claims on Loans Originated and Sold Directly to Fannie Mae Through December 31, 2008 Bank of America Press Release, January, 7, 2013.

- ↑ Dealbook Bank of America Agrees to Buy Back Auction-Rate Securities, New York Times, October 9, 2008.

- ↑ About Us, Organization Website, Accessed March 29, 2013.

- ↑ Louise Story Judge approves SEC Deal with Bank of America, New York Times, February 22, 2010.

- ↑ Kevin Kingsbury Merrill to pay $26.5m to Settle Sales-Practice Probe, Wall Street Journal, September 8, 2009.

- ↑ Alistair Barr & Steve Goldstein, Bank of America to buy Countrywide Financial - Paying $4 billion, entirely in stock, to become nation's top mortgage lender, Wall Street Journal - Market Watch, January 11, 2008.

- ↑ Thomas Catan BofA to Pay $108m in FTC Case, Wall Street Journal, June 8, 2010

- ↑ Halah Touryalai, Citi To Pay $590 Million To Burned Shareholders In Toxic Asset Case, Forbes.com, August 29, 2012.

- ↑ Cora Currier How Citibank Dumped Lousy Mortgages on the Government, ProPublica, February 20, 2012.

- ↑ Eric Dash & Louise Story Citigroup pays $75 million to Settle Subprime Claims, New York Times, July 29, 2010.

- ↑ Liz Rappaport Citigroup, UBS Settle Deal on Payback, Wall Street Journal,. December 12, 2008.

- ↑ Chan, Sewell "Goldman Pays $550 Million to Settle Fraud Case"Accessed 10/1/2012

- ↑ Craig, Susanne and Protess, Ben "Goldman to Pay $12 Million to settle S.E.C. Pay to Play Allegation" Accessed 10/1/2012

- ↑ Greenberg, Jessica. 2 Banks Settle Case for $417 Million Accessed 2/27/2013